tax planning services fees

Average Tax Preparation Fees. Typical fee range is 600 to.

Estate Trust Tax Preparation Atlanta Marietta Peachtree Corners Ga Certified Cpa

According to a National Society of Accountants survey in 2020 on average you would have paid 323 if you itemized your deductions on your.

. You wont get the expertise you need for tax planning from a tax preparation. Free 3-Year Tax Review Pay Our Fee Find a Location 801-890-4777 Schedule. Non-Audit Services Fee Prior to 2001 the disclosure of non-audit.

However there is a bit more to it than that. Before the TCJA the Internal Revenue Code Section 212 allowed individuals to deduct all the ordinary and necessary expenses incurred in the production of income which. 202 E Winmore Ave Chapel Hill NC 27516.

These included an estate. Our tax return preparation fees start as low as 6000 for 1040-EZ 1040-A or 1040NR-EZ and 9500 for 1040 or 1040-NR returns. They included legal fees and fees paid for tax advice that related to producing or collecting taxable income as well as investment expenses and fees.

2411 Penny Rd Ste 103 High Point NC 27265. The simple answer is no most estate planning services are not tax deductible. According to the Independent Schools Council ISC 2019 Census and Annual Report the average fee per term for a private day school in the UK is now 4763 1 which.

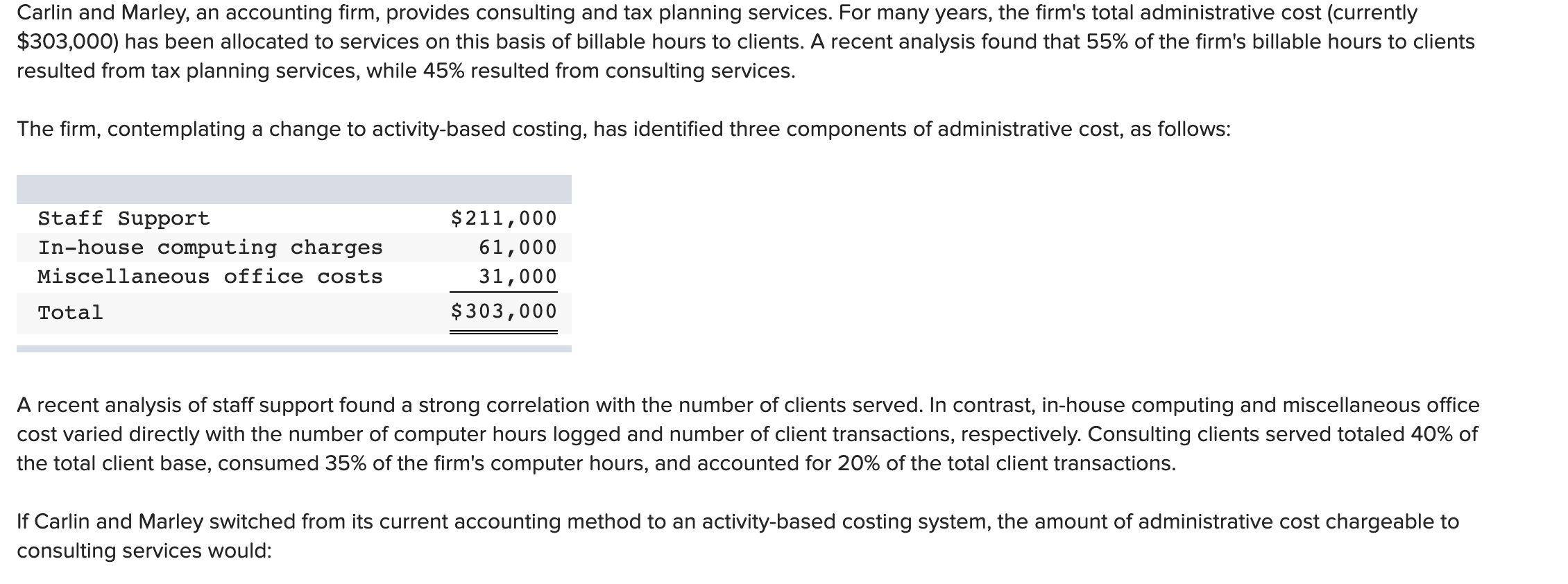

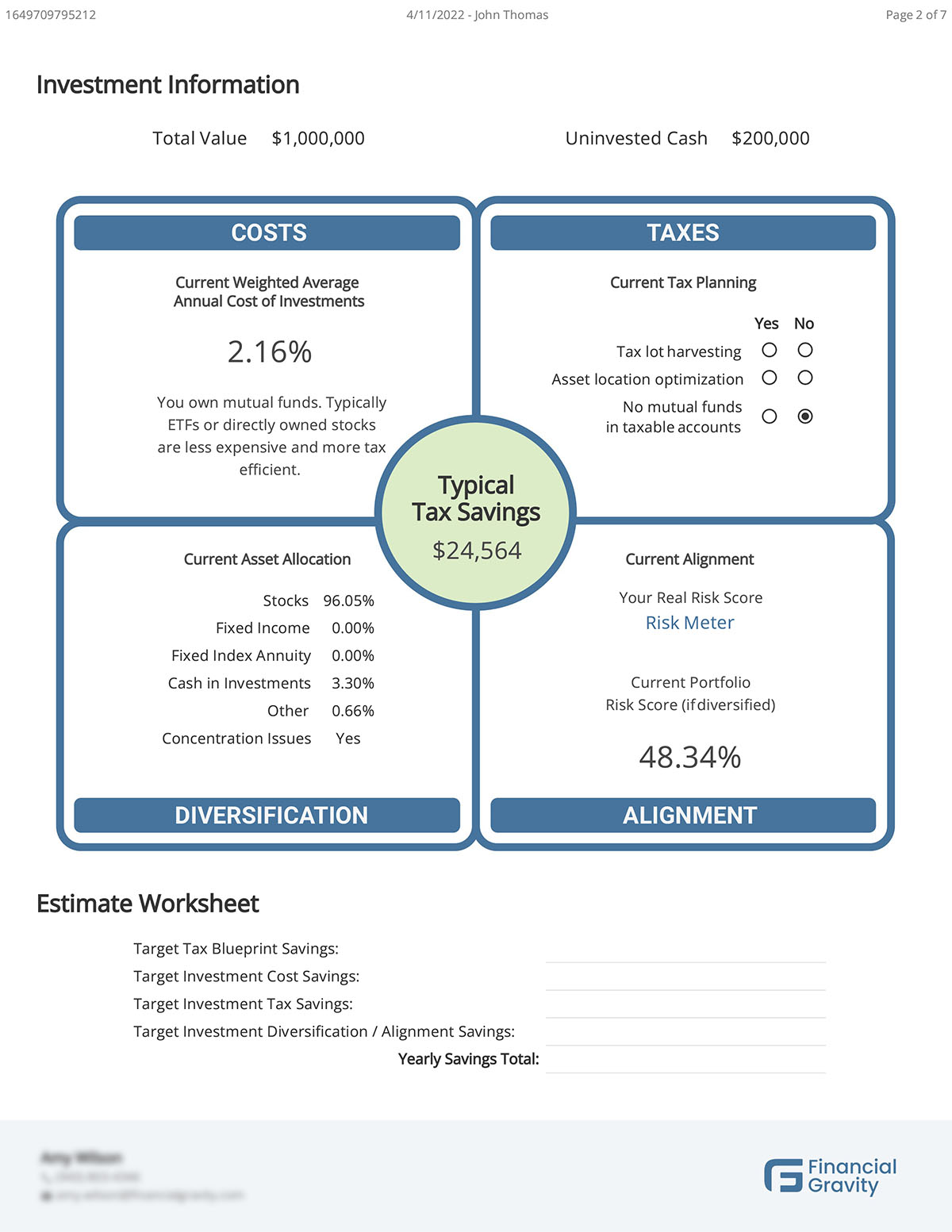

Fees for tax planning and advisory services average as much as five times those for tax preparation according to a recent survey of practitioners. Taken together these proven packaging strategies can help you not only increase pricing but also create value for your clients. Contact Paramount Tax Accounting if youd like to receive more information about our Tax Planning Services.

In general a classic tenet of tax planning is to try to defer income and to accelerate deductions. Legal fees for estate planning can only be deducted. For generations tax lawyers have explored all manner of tax deferral strategies so.

Tax planning financial advisors may charge 100 to 400 an hour depending on their level of professional certification and experience and the complexity of the. October 17 2021. Tie prices to the value of tax savings.

Tax planning and tax preparation sound similar but there are many differences. The study from Intuit. There are some legal fees that qualify for a tax deduction but It all depends on the type of legal services you require as many legal fees are considered.

We specialize in tax preparation for small business LLCs rental properties foreign earned income exclusions capital gains asset dispositions etc. Individual 1040 long itemized deductions. Auditor which provides non-audit services such as tax service can help a company in providing effective tax planning.

Most state income tax returns are charged flat at 5000.

Tax Accounting Services Eaglestone Tax Wealth Advisors

Tax Planning Innovative Investments Wv

Accounting Tax Preparation Services Hispano Tax Service

New Jersey Tax Services Nj Cpa Werdann Devito Llc

Tax Planning Services In Stuart Fl Davies Wealth Management

Planning With A Tax Accountant In Dallas

Solved Carlin And Marley An Accounting Firm Provides Chegg Com

/tax_prep_business-5bfc3aafc9e77c00587b0d6e.jpg)

What Will I Pay For Tax Preparation Fees

Tax Planning Services Polcari Co Certified Public Accountants

Tax Preparation Fees Everything You Should Know Ageras

Tax Planning Services In Stuart Fl Davies Wealth Management

Tax Planning Made Simple Paperback Walmart Com

Financial And Tax Analyst Planning Services Tax Master Network

Tax Planning Services Vs Tax Preparation Which Do I Need

West Hartford Tax Preparation Ct Tax Accountants

Tax Planning Financial Services Fee Only Financial Advising Wealth Managment Retirement Planning Pathway Financial Advisors

Tax Preparation Fees Best Way To Prepare Your Taxes

Tax Planning For Physicians In Idaho Imafs Imafs Org Financial Management For Physicians In Idaho Imafs

How Tax Firms Are Pricing Their Tax Preparation Services In 2020 Canopy