working capital funding strategies

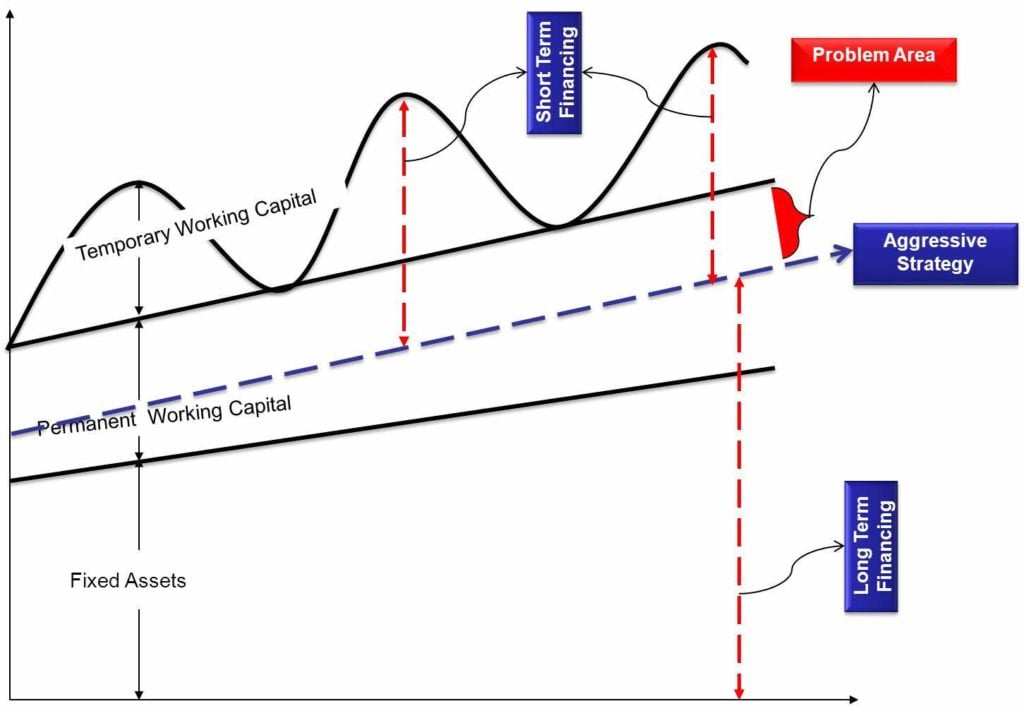

An aggressive policy uses lower levels. On Thursday June 9 the National Academy of Public Administration and Grant Thornton hosted a Working Capital Fund.

/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)

Working Capital Formula Components And Limitations

02 Past Paper 248 C3a.

. Here are a few working capital funding strategies you should consider. Strategies to Manage Working Capital. Working Capital Fund June 2022.

Working capital funding strategies Sunday. Capital funding is the money that lenders and equity holders provide to a business. 6 Steps to Building a Solid Working Capital Plan.

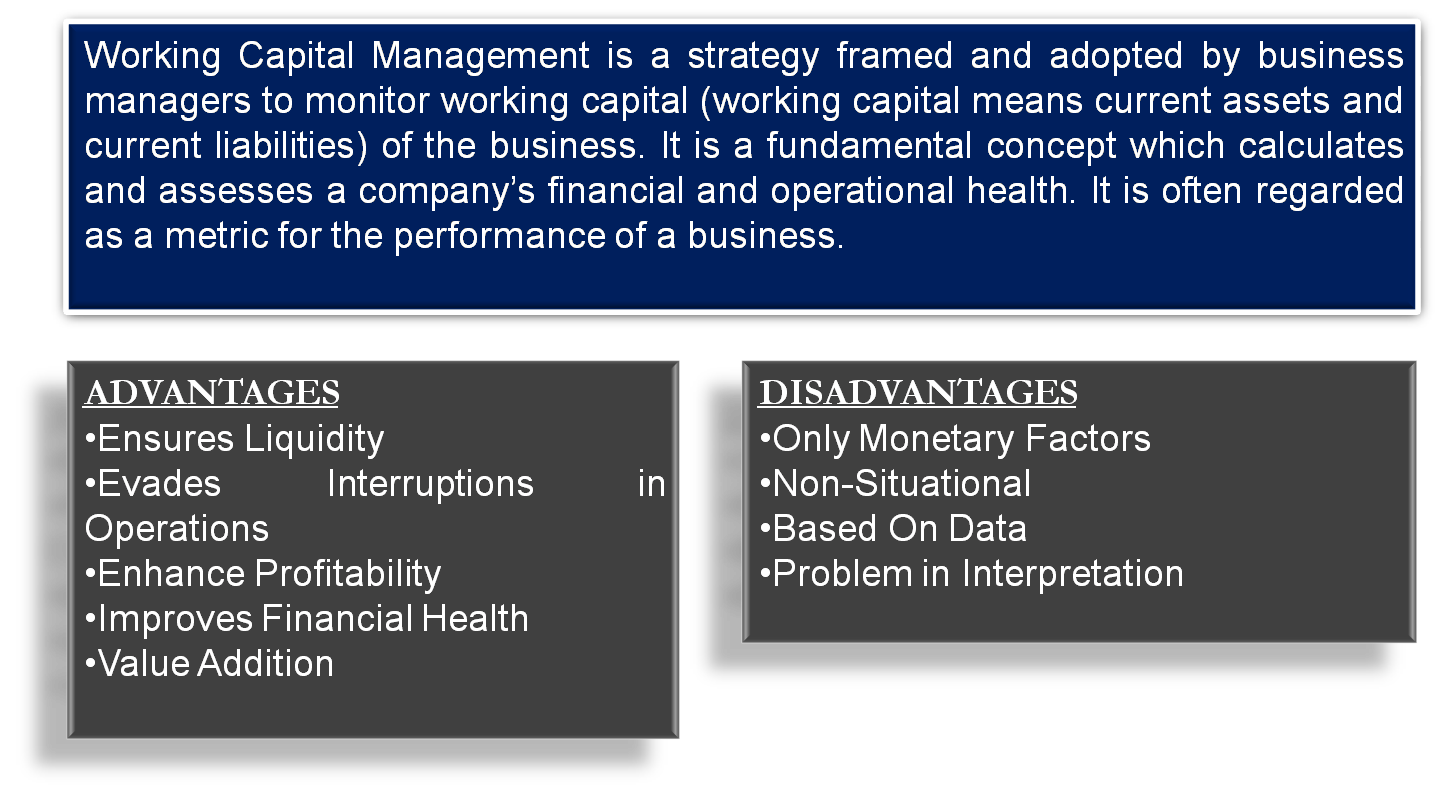

Even companies in the same industry will have different levels of inventory and receivables due to their differing policies. A well-executed working capital management strategy can create a virtuous circle of improved profitability increased cash flow and better long-term financial performance. Its primarily used to free up capital so a business can meet short and medium-term commitments and continue to grow.

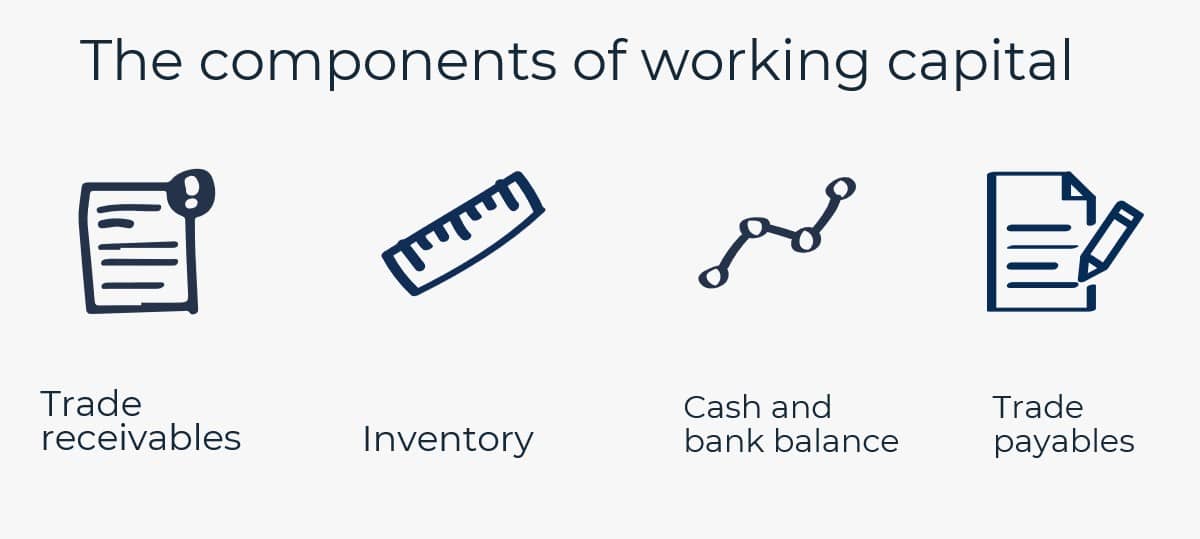

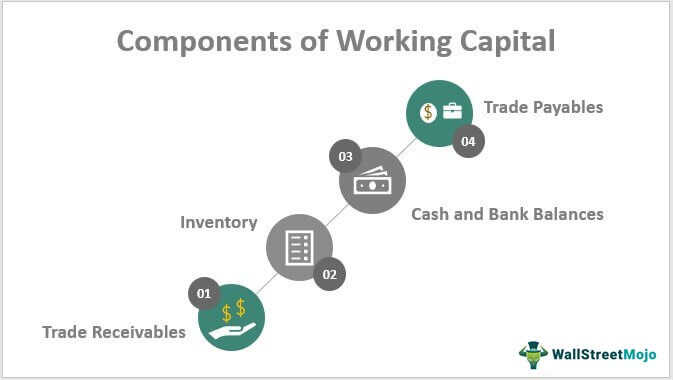

More simply put its the actual money you have on hand to meet your current and short-term. Working capital is difference between a companys current assets and current liabilities. Some retailors use inventory turns instead of DIO.

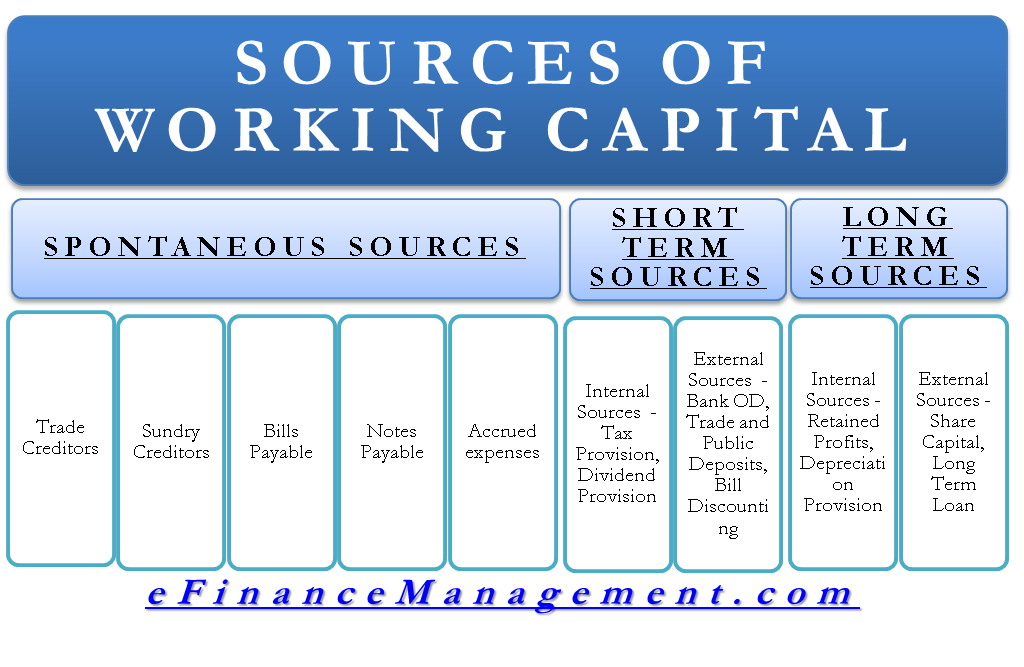

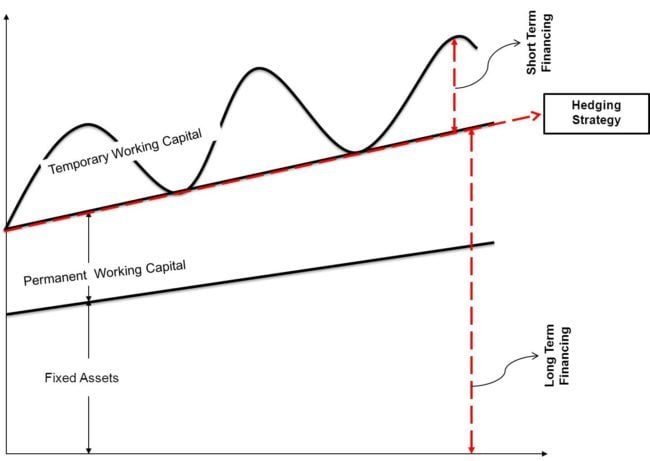

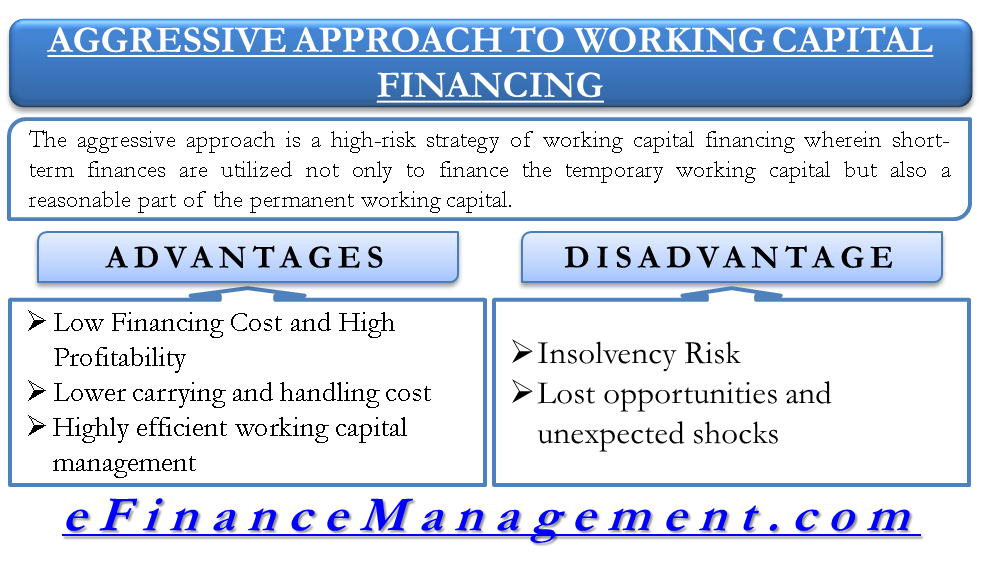

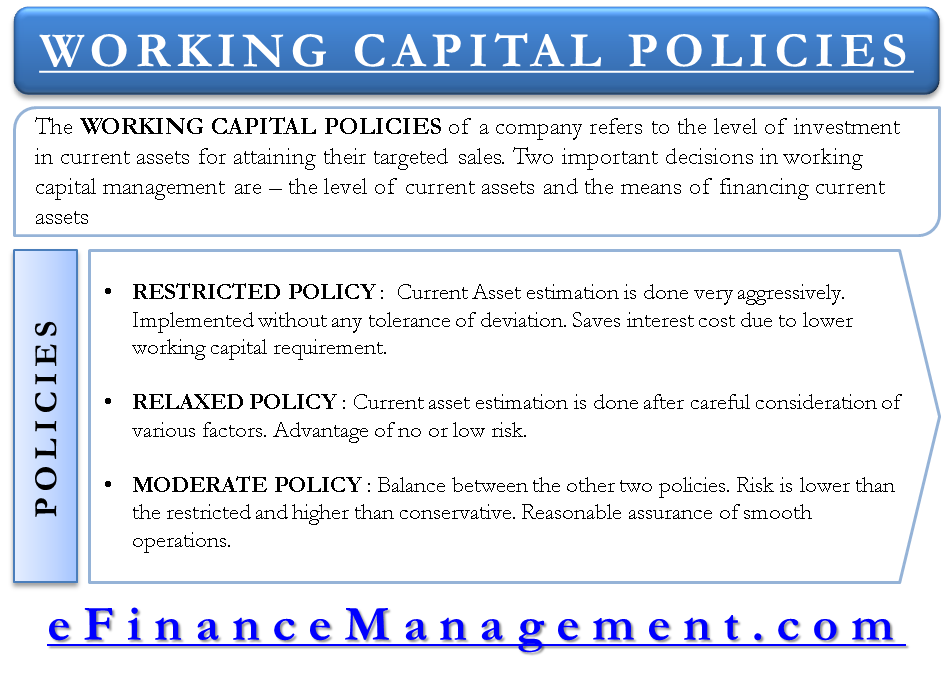

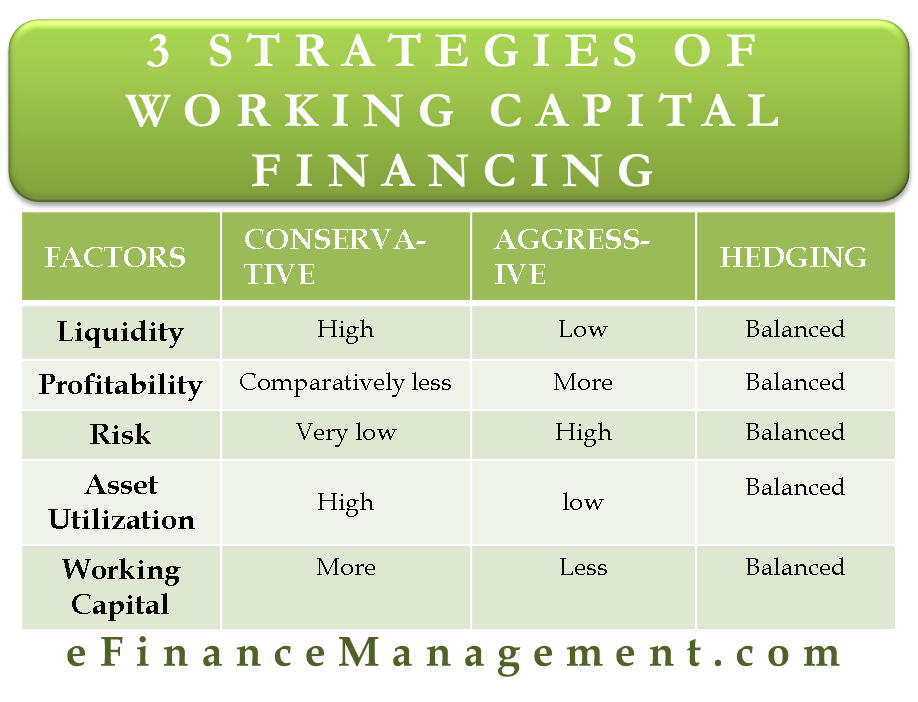

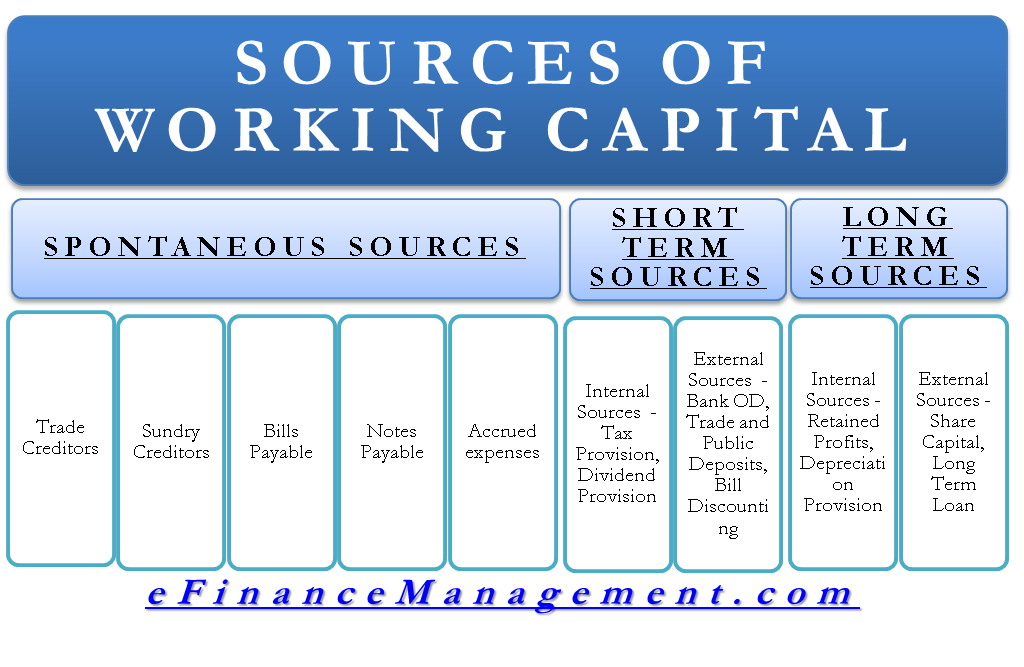

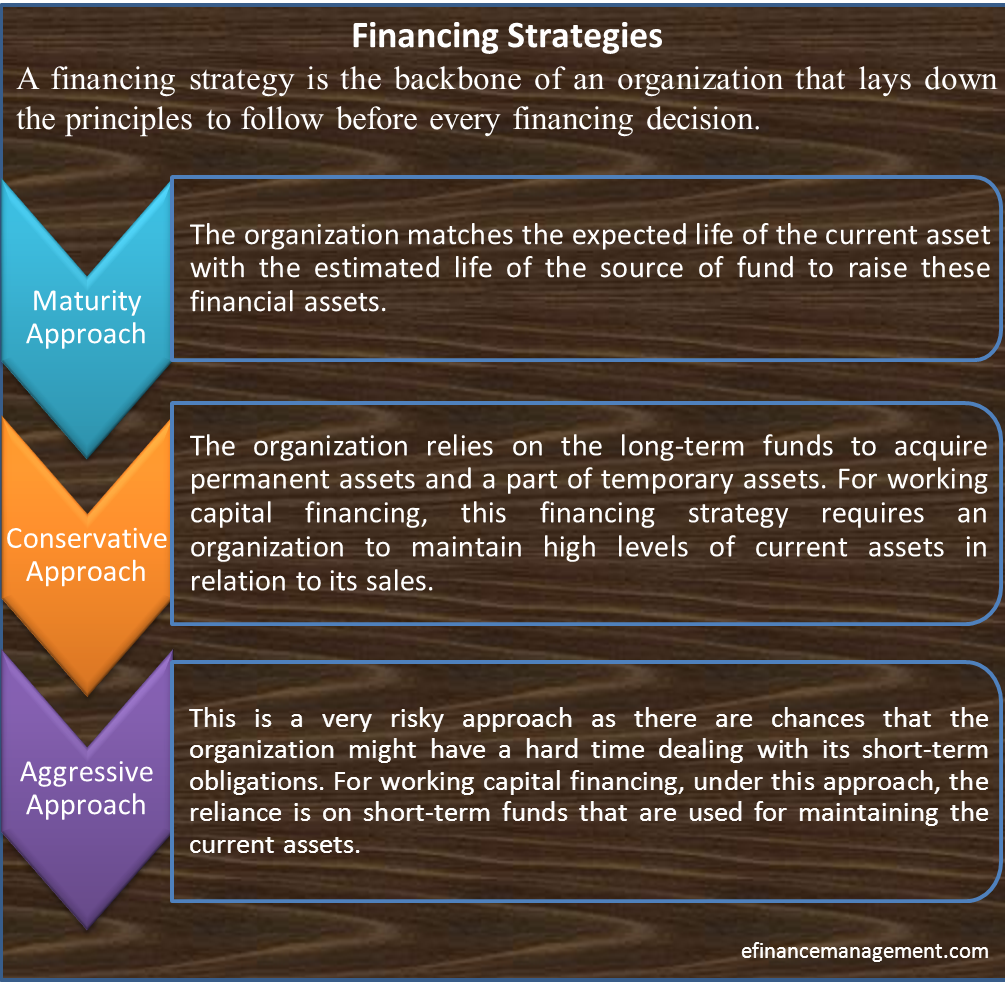

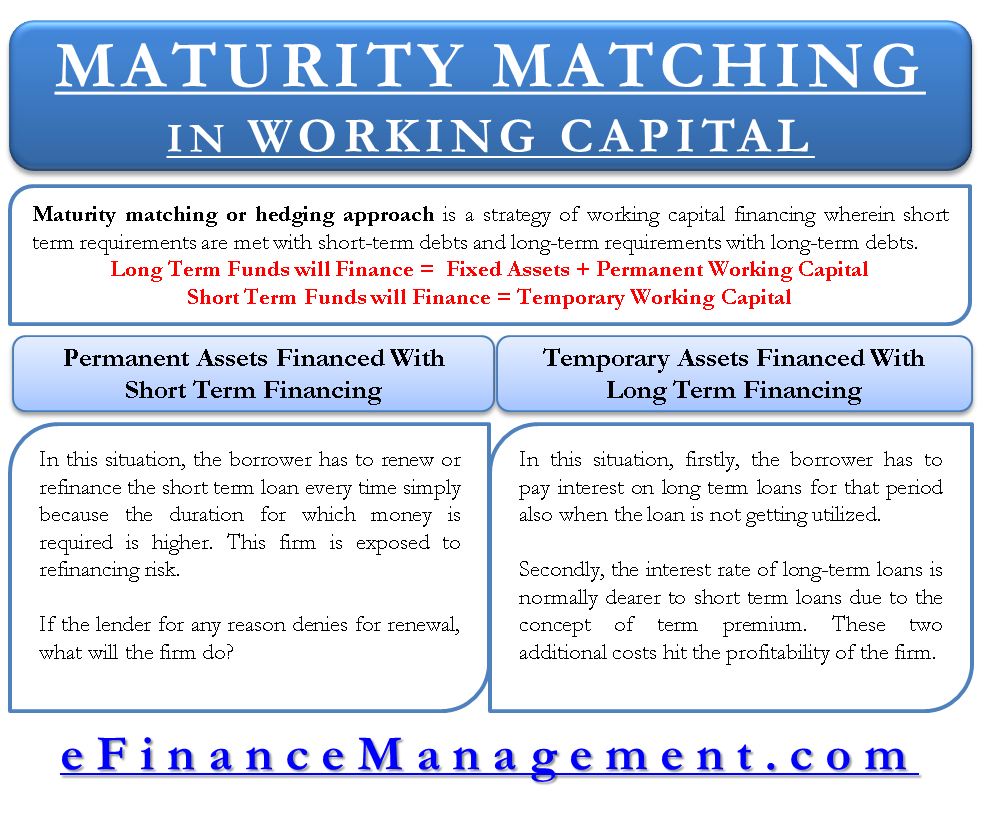

Broadly three strategies can help optimise working capital financing for a business namely hedging aggressive and conservative as per the risk levels involved. Conservative Approach As the name speaks for itself this strategy finances working capital with low risk and profitability. Each comes with its advantages and.

Working capital financing will primarily be. There are broadly 3 working. Working capital finance is funding designed to improve cash flow and liquidity.

Company and degree of conservativeness of working capital investment and financing policies. There are three main strategies for working capital management. The company yields a positive return if it follows a conservative working capital policy ie.

Working Capital Funding Strategies. Level of Investment in Current Assets. Taking out a working capital loan Since its imperative for organizations that have sufficient revenue.

Working capital funding strategies Saturday May 7 2022 Edit. 3 Working Capital Management Strategies. Different elements of working capital such as bills receivable cash inventory etc need to be taken care of in order to manage working.

The following points highlight the top approaches of working capital management strategies. 150 North American retailers with 50m or more in annual revenue. 01 Explanation 155 C3a.

The hedging approach is an ideal. Company values rise above a major network. 03 Past Paper 233 C3a.

The two metrics are calculated differently but are interchangeable and measure the same effect higher DIO is the same as lower turns.

Working Capital Management Conservative Approach Efm

Working Capital Optimization Through Payment Terms

Growth Equity Primer Expansion Capital Investment Strategy

Maturity Matching Or Hedging Approach Rationale Pros Cons Example

Aggressive Approach To Working Capital Financing Management Efm

Working Capital Cycle What Is It With Calculation

Working Capital Types Of Working Capital Learn Accounting Investing Finance

Working Capital Policy Relaxed Restricted And Moderate

Components Of Working Capital Top 4 Detailed Explained

Aggressive Approach To Working Capital Financing Management Efm

Working Capital Cycle Efinancemanagement

Compare 3 Strategies Of Working Capital Financing

Financing Strategies Matching Conservative Aggressive Approach

Spontaneous Sources Of Working Capital Finance

:max_bytes(150000):strip_icc()/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)

Working Capital Formula Components And Limitations

Types Of Working Capital Gross Net Temporary Permanent Efm

Advantages And Disadvantages Of Working Capital Management

Financing Strategies Matching Conservative Aggressive Approach

Maturity Matching Or Hedging Approach Rationale Pros Cons Example